Blockchain and Parametric Insurance: A Game-Changer in Risk Management

Imagine a small farmer in Southeast Asia whose livelihood is threatened by a sudden and…

Parametric insurance has existed for over 25 years. However, despite its transformative approach to managing climate risks, adoption remains limited. Infrastructure gaps, economic constraints, and basis risk often challenge its implementation. Yet, countries worldwide continue to explore parametric models, showcasing diverse strategies to overcome these hurdles.

Global parametric insurance applications are renowned for their data-driven approach to monitoring risks. Objective triggers and automated payouts provide a seamless financial safety net for those most vulnerable to extreme climate changes, fostering resilience and adaptability.

Global parametric insurance applications across the globe highlight varied results and innovations:

While global parametric insurance applications have seen success, their adaptation is limited due to various systemic and operational challenges:

The complexity of parametric models often leads to misunderstandings among policyholders. Transparent communication and technologies like blockchain, which ensure process traceability, can mitigate skepticism. Educating stakeholders on the benefits of these models is vital for their credibility.

Many regions lack the technological and financial systems necessary for smooth implementation. Investments in digital infrastructure and data collection tools are crucial to bridging these gaps.

Subsidy-dependent programs are vulnerable during economic downturns, as seen with Mexico’s CADENA. Diversifying funding sources can enhance program sustainability.

Predefined triggers may not always align with actual losses, e.g., rainfall triggers not reflecting pest-related crop damage. Advanced risk models and data analytics are essential to reducing this mismatch.

The absence of a unified framework tailored to parametric insurance hinders its global expansion. Policymakers must create adaptive regulations that encourage innovation while maintaining accountability.

International practices highlight strategies for successful implementation:

Collaborative efforts between governments and private insurers enhance funding, technical expertise, and scalability. These partnerships can create resilient systems that address both local and global challenges.

IoT devices, satellite imaging, and analytics refine triggers for greater accuracy. Real-time data integration ensures that policy triggers are precise, reliable, and timely.

Localized policies tailored to specific needs build trust and relevance, ensuring greater adoption and impact. Engaging communities in the design and rollout of policies fosters ownership and transparency.

Programs like the World Food Programme’s R4 Rural Resilience Initiative combine risk reduction with parametric insurance, benefiting nearly 550,000 households across 18 countries. These initiatives demonstrate how global partnerships can scale parametric models effectively.

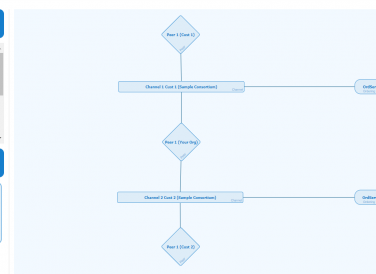

Blockchain technology is revolutionizing global parametric insurance applications by ensuring transparency and automating payouts. Platforms like AstraKode Blockchain simplify blockchain integration for insurers, offering visual no-code environments to build private networks and develop smart contracts efficiently. The Smart Contract Auditor further enhances security by identifying vulnerabilities in smart contracts, reducing reliance on costly third-party audits. For an in-depth exploration of blockchain’s role, read Parametric Insurance: A Game-Changer in Risk Management.

Global parametric insurance applications are not just an innovation; they are a crafted solution for complex risks. From Kenya to the Caribbean, their success stories demonstrate how technology, collaboration, and tailored solutions can deliver financial resilience where needed most. These models, when combined with advanced technology and strategic partnerships, represent a paradigm shift in how we approach risk management.

To explore global parametric insurance applications further, visit AstraKode. Together, we can create a future where resilience and adaptability are accessible to all, regardless of geography or economic constraints.

Imagine a small farmer in Southeast Asia whose livelihood is threatened by a sudden and…

The blockchain market has been constantly growing in the latest years, and is now approaching…

A few days ago the first demo video of AstraKode Blockchain was published on AstraKode’s YouTube channel. The video showcases…